- Opening hours : Monday to Friday from 8:30 to 17:00

We use cookies to analyze web traffic. No personal data is collected, and your visit is anonymized to protect your privacy.

The Cabinet announced the 2025 Tax Plan during Budget Day on Sept. 17. Below are the changes:

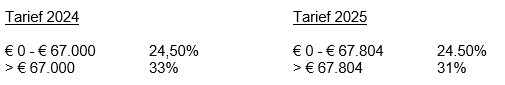

Reduce rate in box 2

In the 2024 tax plan, the flat-tax rate was changed to two brackets. The basic rate was reduced to 24.5%, but from €67,000 a director-major shareholder pays the high rate of 33%. As a result, the current tax rate on Box 2 income is a maximum of 50.29%. This is higher than that for employees at 49.5% and certainly higher than that for the IB entrepreneur, when you also take into account the SME profit exemption and the self-employed deduction. With the reduction to 31% from €67,804, this is (partly) corrected.

Tightened regulation on labor, knowledge and study migrants

The numbers of labor migrants will be curtailed. Labor migration at low wages will be restricted and the conditions for knowledge and study migration will be tightened.

Employers themselves must ensure that labor migrants have a command of the Dutch language during long-term stays in the Netherlands. With these measures, the Cabinet wants to reduce the often poor working and living conditions.

For every Dutch student who goes abroad, six international diploma students return to the Netherlands. The influx of these students causes unacceptable pressure on both housing and teachers and full lecture halls.

In addition, the cabinet feels that too little Dutch is spoken. The Dutch language should become more leading again instead of the English language.

Compensation of transition compensation

From July 1, 2026, only small employers (< 25 employees) will still be eligible for transition compensation for employees who leave employment after long-term illness. This is expected to result in a government saving of 70% on these costs. Larger employers will no longer receive compensation for the transition compensation as of July 1, 2026.

Modifications to the business succession regime (BOR)

Through a legislative amendment already passed and in part through a proposed legislative amendment, the BOR will be modified. This will make it more applicable where it is needed and limit use of the BOR for which it is not intended.

Versobering gift deduction

The gift deduction in corporate income tax (vpb) will be abolished by 01-01-2025. What does this mean if you, as a business owner, want to support a charity?

If companies support charities through sponsorship or advertising, these are not donations but business expenses, which are deductible from the profit for corporate income tax purposes just like other business expenses. The remainder of donations are made from shareholder motives (a shareholder's desire to support a charity). These expenses are non-business and will soon no longer be deductible for corporate income tax purposes. They are considered distributions subject to dividend tax.

Deductible

This makes the gift an income in box 2 for the DGA. In fact, it is an expense in private for the substantial interest holder. This allows them to deduct the gift from their income in private in the form of a personal deduction. The government is of the opinion that for the treatment of the deductibility of gifts, it should not matter whether the money comes from a company or privately from other sources: as a result, the regulation giving from the

company is superfluous.

SME profit exemption not reduced further after all

In last year's tax plan, the SME profit exemption was reduced from 14% to 13.31%. Further reductions were proposed in the Spring Memorandum. This was blocked in the coalition program.

The tax plan states that this exemption will be reduced to 12.7% as of January 1, 2025. An additional reduction to 12.03% was proposed in this year's Spring Memorandum, which announced a variety of tax measures. This additional reduction will not go through.

However, the IB entrepreneur still faces a measure that reduces his net disposable income.

As previously established, the self-employed deduction will be further reduced to € 2,470 in 2025. This was still €3,750 in 2024. This measure also reduces the net disposable income of the IB entrepreneur.

Sales tax changes

Amendment small business arrangement

As of January 1, 2025, the small business allowance (hereinafter: KOR) will be changed. The KOR applies to entrepreneurs with a turnover of up to €20,000 per year. If an entrepreneur falls under the KOR, he does not have to charge VAT and is not allowed to offset VAT. The entrepreneur does not have to file a sales tax return,

which reduces the administrative burden.

Mandatory participation period expires .

An entrepreneur must now participate in the KOR for a minimum of three years. This mandatory participation period will expire. An entrepreneur can opt out at any time.

Shorter waiting period for re-enrollment .

The waiting period will also be changed. Whereas an entrepreneur must now wait three years before reapplying for the KOR, this period will be limited to the calendar year of deregistration and the following calendar year.

Revision regulation for investment services real estate

As of January 1, 2026, a VAT review period of five years will apply to investment services to immovable property that exceed €30,000.

Introduction of EU KOR

From January 1, 2025, entrepreneurs based in the Netherlands will also be able to apply for a KOR for EU countries with which they trade.

More room for lower WW premium

As of Jan. 1, 2025, employers will pay the lower WW overtime rate for employees with a fixed contract of more than 30 hours per week on average. Until that date, the limit is 35 hours per week.

To increase the agility of employers, the cabinet wants to introduce more flexibility in permanent contracts. As a result, a larger group of workers on permanent contracts who work more than 30% overtime will be covered by the low WW premium. Employers can thus make more employees with relatively large permanent contracts more flexible at the low WW premium. Moreover, employees with flexible contracts more often enter the WW and the WW costs are passed on more fairly with this premium differentiation.

The lowering of the limit will save employers a total of about 15.5 million euros. The cabinet has budget for this. This adjustment is part of a broader package of measures with which the cabinet wants to reform the labor market. The goal is to create a better balance between security and flexibility on the labor market.

General tax credit will be reduced

The general tax credit will be reduced by €335 to €3,068 as of 01-01-2025.

Deduction of specific care costs will be simplified

As of 01-01-2025, the regulations for specific care costs for the deduction of care and living kilometers will be simplified. For visiting a doctor, hospital or pharmacy (care kilometers), a fixed amount of €0.23 per kilometer will be deductible. In addition, if a serious illness or disability necessitates additional transportation costs (living kilometers), a fixed amount of € 925 may be deducted.

Travel expenses incurred by cab or public transportation remain deductible at the actual costs incurred. The regulation is amended so that all people belonging to the household at the time the nursing commences can claim this deduction, if they regularly visit the nursing person.

Box 3 rate will remain 36%

As of Jan. 1, 2025, the 36% rate will remain in Box 3. The exemption for box 3 will increase to €57,684 per person.

Conveyance tax will be reduced

The transfer tax rate will be reduced from 10.4% to 8% for the purchase of an investment home or vacation home on January 1, 2026. The reduced rate of 2% or an exemption for first-time buyers will continue to apply if the buyer will occupy the home as their primary residence.

Energy tax on natural gas will be reduced

As of January 1, 2025, the energy tax on natural gas will be reduced. As a result, everyone will pay €29 less energy tax in 2025.

Business electric car addition up

As of January 1, 2025, the addition for fully electric company cars for private use will increase from 16% to 17%. The addition limit remains €30,000; above that the regular addition of 22% will apply.

30% ruling will be tightened

The 30% rule will be adjusted to a 27% rule as of January 1, 2027. The maximum untaxed allowance of 27% will apply for five years. The salary standard will be increased from €46,107 to €50,436 as of January 1, 2027.

Double counting excessive borrowing will be prevented

As of January 1, 2025, there will be a new regulation regarding excessive borrowing to prevent

prevent unforeseen double counting at partnerships. This regulation will apply retroactively to January 1, 2023. Double counting occurs in the situation where taxpayers participate.

Limitation on deduction of costs of non-self-employed workspace clarified

As of January 1, 2025, it is clarified that costs for a non-self-contained workspace in a home that is part of the business assets are not deductible if these costs would be borne by the tenant in a rental situation. This concerns costs for furnishings, gas, water and light.

0 Comments